How much is auto insurance in Massachusetts? This question often leads to a deep dive into the factors influencing rates, the average costs for different vehicles, and tips for saving money. Let’s explore all these aspects in detail.

Understanding Auto Insurance in Massachusetts

Auto insurance rates in Massachusetts are influenced by several factors, including:

- Your driving record: A clean driving record typically leads to lower insurance rates, while accidents and traffic violations can result in higher premiums.

- Your age and experience: Younger and less experienced drivers usually pay more for auto insurance due to higher risk.

- The type of coverage you choose: Different levels of coverage, such as liability, collision, and comprehensive, will impact your insurance rates.

- The make and model of your vehicle: The cost to repair or replace your vehicle, as well as its safety features, can affect your insurance premiums.

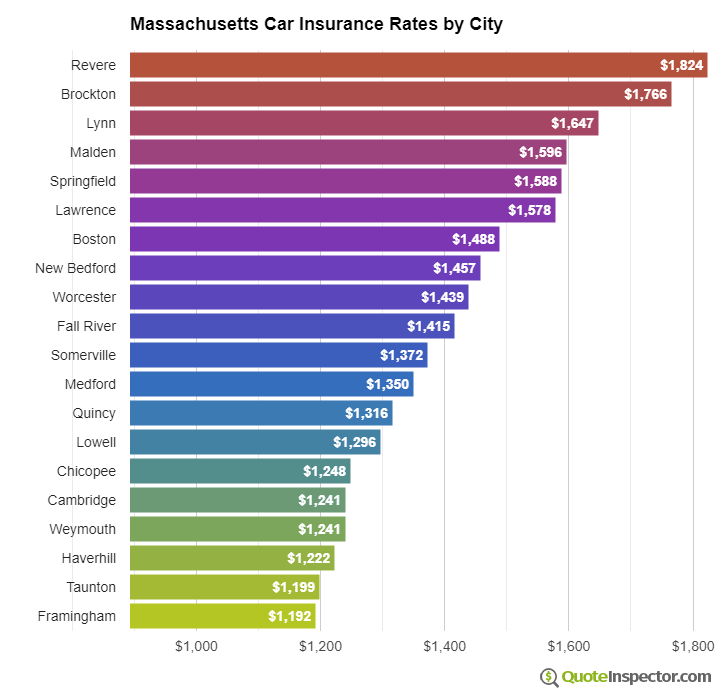

- Your location: Urban areas with higher rates of accidents and theft may result in higher insurance costs.

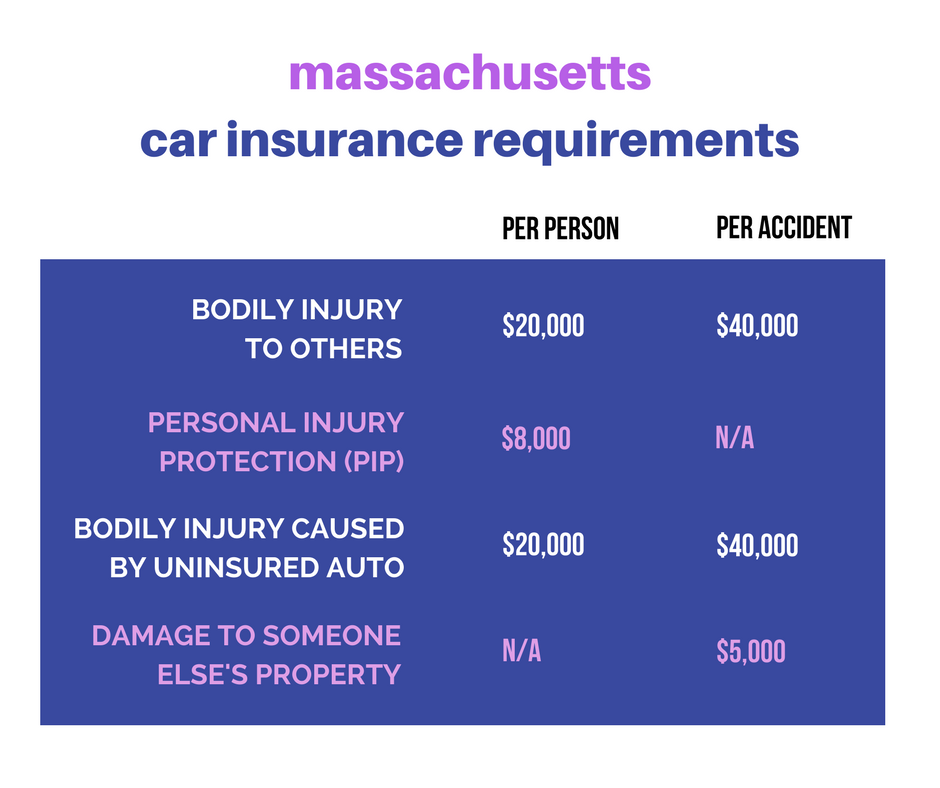

Minimum Auto Insurance Requirements in Massachusetts

Massachusetts law requires all drivers to carry a minimum amount of auto insurance coverage, including:

| Coverage Type | Minimum Coverage Amount |

|---|---|

| Bodily Injury Liability | $20,000 per person / $40,000 per accident |

| Property Damage Liability | $5,000 per accident |

| Personal Injury Protection (PIP) | $8,000 per person, per accident |

| Uninsured Motorist Coverage | $20,000 per person / $40,000 per accident |

Importance of Having Auto Insurance in Massachusetts

Having auto insurance in Massachusetts is crucial for several reasons, including:

- Legal requirement: It is mandatory by law to have auto insurance in Massachusetts to protect yourself and others in case of accidents.

- Financial protection: Auto insurance can help cover the costs of repairs, medical expenses, and legal fees in the event of an accident.

- Peace of mind: Knowing that you are financially protected in case of unexpected events on the road can provide peace of mind while driving.

Average Cost of Auto Insurance in Massachusetts

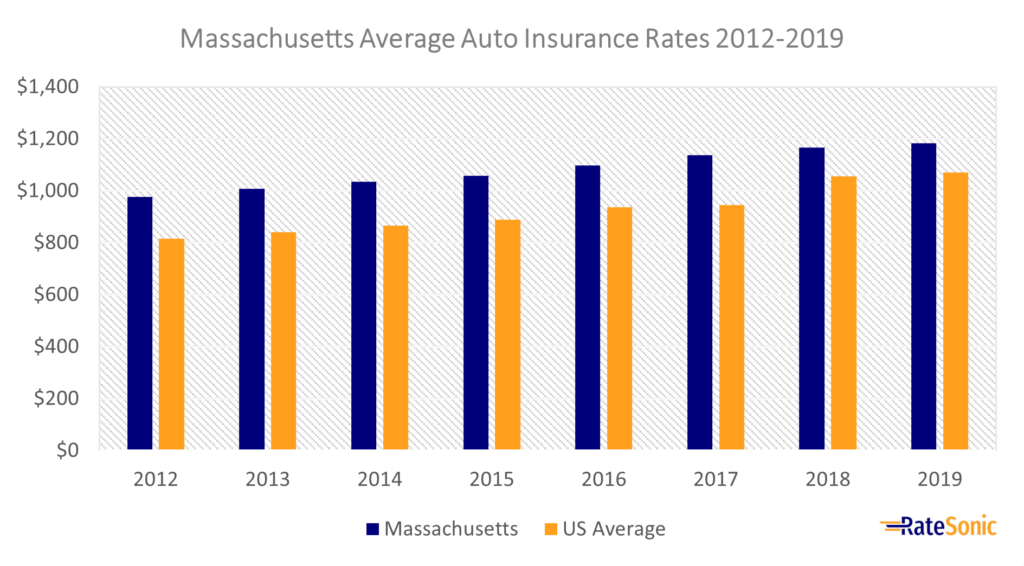

Auto insurance rates in Massachusetts can vary based on several factors, including the type of vehicle, age of the driver, driving record, and coverage levels. On average, the cost of auto insurance in Massachusetts is relatively high compared to other states in the US.

Average Cost for Different Types of Vehicles, How much is auto insurance in massachusetts

When it comes to different types of vehicles, the average cost of auto insurance in Massachusetts can vary. Generally, sports cars and luxury vehicles tend to have higher insurance premiums compared to standard sedans or compact cars. This is due to the increased risk associated with these types of vehicles.

Comparison to Other States

Compared to other states in the US, Massachusetts often ranks among the top states with higher auto insurance rates. Factors such as the state’s population density, weather conditions, and frequency of accidents can contribute to the higher premiums in Massachusetts.

Factors Affecting Auto Insurance Rates

Various factors can influence auto insurance rates in Massachusetts. Age is a significant factor, with younger drivers typically facing higher premiums due to their lack of driving experience. Additionally, a driver’s driving record plays a crucial role in determining insurance rates, with drivers with a clean record often receiving lower premiums. The coverage levels chosen by the driver, such as liability coverage, comprehensive coverage, and collision coverage, also impact the overall cost of auto insurance in Massachusetts.

Tips for Saving on Auto Insurance in Massachusetts

When it comes to auto insurance in Massachusetts, there are several strategies you can use to lower your premiums and save money. From bundling policies to raising deductibles, understanding these tips can help you make informed decisions to reduce your auto insurance costs.

Bundling Policies

One effective way to save money on auto insurance in Massachusetts is by bundling your policies. This means purchasing multiple insurance policies, such as auto and home insurance, from the same provider. By bundling your policies, insurance companies often offer discounts, ultimately reducing your overall insurance costs.

Raising Deductibles

Raising your deductibles is another strategy to consider when looking to save on auto insurance in Massachusetts. By opting for a higher deductible amount, you can lower your monthly premiums. However, it’s important to assess your financial situation and determine a deductible amount that you can comfortably afford in the event of a claim.

Finding the Best Auto Insurance Provider in Massachusetts: How Much Is Auto Insurance In Massachusetts

When looking for the best auto insurance provider in Massachusetts, it’s essential to consider various factors such as customer reviews, ratings, customer service, claims handling, and coverage options. Here are some tips to help you find the right auto insurance provider for your needs in Massachusetts.

Compare Different Auto Insurance Companies

- Research and compare different auto insurance companies in Massachusetts based on customer reviews and ratings.

- Consider the financial stability and reputation of the insurance companies to ensure they can meet their obligations in case of a claim.

Importance of Customer Service and Claims Handling

- Choose an auto insurance provider in Massachusetts known for excellent customer service and efficient claims handling.

- Read reviews and testimonials from current or past customers to get an idea of how the insurance company treats its clients.

Tips for Research and Selection

- Define your insurance needs and priorities before starting your search for an auto insurance provider in Massachusetts.

- Get quotes from multiple insurance companies to compare prices and coverage options.

- Check for discounts and special offers that may help you save on your auto insurance premium.

- Consider bundling your auto insurance with other policies like home or renters insurance for additional savings.

Concluding Remarks

In conclusion, understanding the intricacies of auto insurance in Massachusetts is vital for making informed decisions. By knowing the factors that impact costs and ways to save money, individuals can navigate the insurance landscape with confidence.

Clarifying Questions

What are the main factors influencing auto insurance rates in Massachusetts?

The main factors include driving record, age, type of vehicle, coverage levels, and even the area where the vehicle is primarily driven.

How does bundling policies help in saving money on auto insurance in Massachusetts?

When you bundle multiple insurance policies with the same provider, you often qualify for discounts, reducing the overall cost of insurance.

Why is it important to consider customer service when choosing an auto insurance provider in Massachusetts?

Good customer service ensures that your needs are met efficiently, especially during claims processes, making the overall experience smoother.