Starting with AARP secondary insurance to Medicare, this introductory paragraph aims to provide an enticing glimpse into the topic, highlighting the key aspects that will be explored further.

As individuals navigate the complexities of Medicare coverage, understanding the role of AARP secondary insurance can provide additional support and benefits that enhance their overall healthcare experience.

Overview of AARP Secondary Insurance to Medicare

AARP secondary insurance is a supplemental insurance plan that works alongside original Medicare coverage to provide additional benefits and coverage for healthcare expenses.

Benefits of AARP Secondary Insurance with Medicare

- Extended Coverage: AARP secondary insurance helps cover costs that Medicare may not fully pay for, such as copayments, deductibles, and coinsurance.

- Additional Services: AARP secondary insurance often includes benefits like vision, dental, and hearing coverage, which are not typically covered by Medicare.

- Travel Benefits: Some AARP secondary insurance plans offer coverage for emergency medical expenses when traveling outside the United States, filling gaps in Medicare coverage.

Eligibility Criteria for AARP Secondary Insurance to Medicare

When it comes to eligibility for AARP secondary insurance to Medicare, there are specific criteria that individuals must meet in order to enroll in this supplemental coverage.

Who is Eligible for AARP Secondary Insurance When Already Enrolled in Medicare?

- Individuals who are already enrolled in Medicare Part A and Part B are eligible to apply for AARP secondary insurance.

- Medicare beneficiaries looking for additional coverage, such as prescription drugs, dental, vision, or hearing benefits, can opt for AARP secondary insurance.

Age or Membership Requirements for Obtaining AARP Secondary Insurance

- There are no specific age requirements to enroll in AARP secondary insurance, as long as the individual is already enrolled in Medicare.

- Membership in AARP is a prerequisite for obtaining AARP secondary insurance, but individuals can join AARP at any age to access the benefits of this supplemental coverage.

How Eligibility for AARP Secondary Insurance Differs from Medicare Eligibility

- While Medicare eligibility is primarily based on age (65 or older) or certain disabilities, AARP secondary insurance eligibility is open to individuals of any age who are already enrolled in Medicare.

- AARP secondary insurance offers additional benefits and coverage options beyond what traditional Medicare provides, making it a valuable supplement for many Medicare beneficiaries.

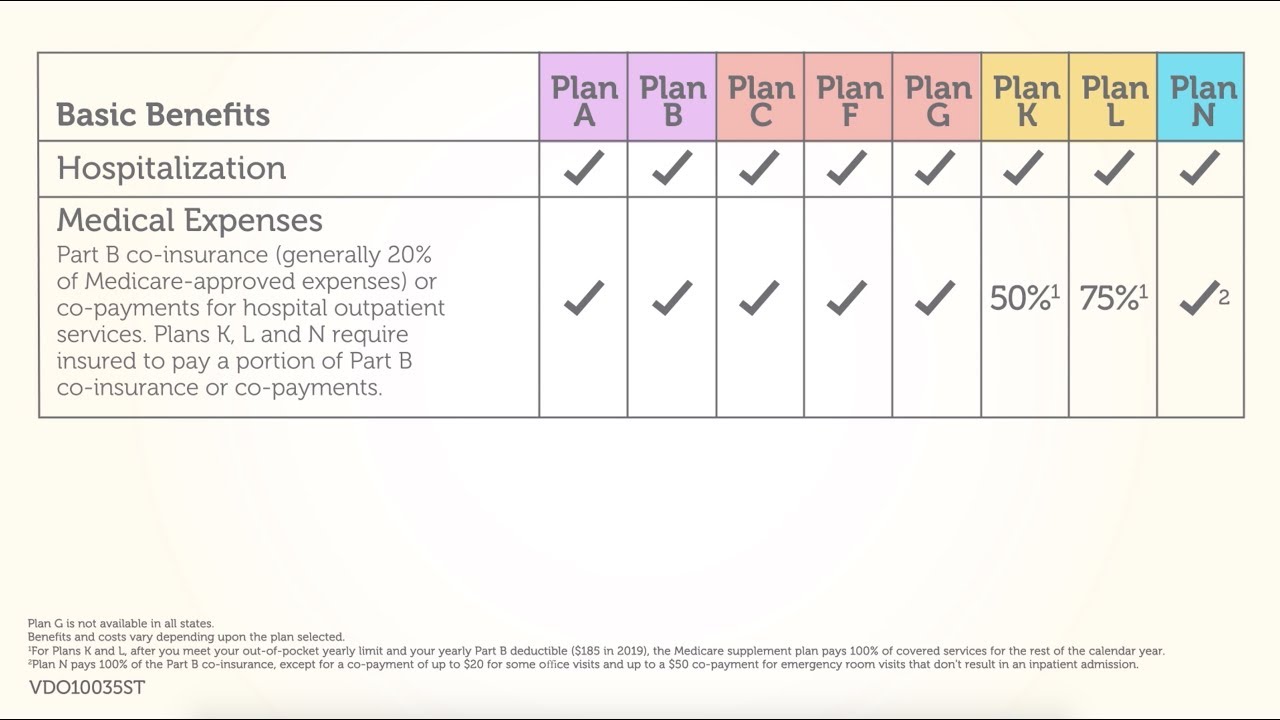

Coverage and Benefits of AARP Secondary Insurance to Medicare

When it comes to AARP secondary insurance in addition to Medicare, there are various areas of coverage and benefits that policyholders can enjoy. Let’s take a closer look at what AARP secondary insurance has to offer.

Areas of Coverage Provided by AARP Secondary Insurance

- Hospital stays and inpatient care

- Doctor visits and outpatient services

- Prescription drugs

- Preventive care services

- Emergency care and ambulance services

Comparison of Benefits with Medicare Alone

- AARP secondary insurance may cover deductibles, copayments, and coinsurance that Medicare does not cover.

- Additional benefits such as vision, dental, and hearing coverage may be included with AARP secondary insurance.

- Some plans offer worldwide emergency coverage, which Medicare typically does not cover.

Unique Benefits of AARP Secondary Insurance

- Wellness programs and discounts on health-related products and services

- Access to personalized health information and resources

- Travel benefits, including coverage for medical emergencies while traveling

Cost and Premiums for AARP Secondary Insurance to Medicare

When considering AARP secondary insurance in relation to Medicare, it’s essential to understand how the costs and premiums are structured. AARP secondary insurance works alongside Medicare to provide additional coverage that may not be included in Original Medicare. Let’s delve into the details of how the cost and premiums work for AARP secondary insurance.

Cost Structure

The cost of AARP secondary insurance is separate from the premiums you pay for Medicare coverage. While Medicare premiums are set by the government and vary based on factors like income and the type of Medicare plan you choose, the premiums for AARP secondary insurance are determined by AARP and may vary based on factors such as age, location, and the specific plan you select.

Out-of-Pocket Expenses

In addition to the monthly premiums for AARP secondary insurance, there may be out-of-pocket expenses associated with this coverage. These expenses can include deductibles, copayments, and coinsurance for covered services. It’s important to review the details of your AARP secondary insurance plan to understand what out-of-pocket costs you may be responsible for.

Factors Affecting Premiums

Premiums for AARP secondary insurance can vary based on different factors. For example, premiums may be higher for older individuals compared to younger enrollees. Additionally, the level of coverage and benefits included in the plan can impact the premium amount. Factors like tobacco use, geographic location, and the specific AARP plan you choose can also influence the cost of premiums.

How to Enroll in AARP Secondary Insurance

When it comes to enrolling in AARP secondary insurance as a Medicare beneficiary, there are specific steps to follow to ensure a smooth process and timely coverage. Below are the essential details you need to know:

Enrollment Process for AARP Secondary Insurance, Aarp secondary insurance to medicare

- Contact AARP: Reach out to AARP to express your interest in enrolling in their secondary insurance plan. You can do this by phone, online, or through their local offices.

- Provide Information: Be prepared to provide personal details such as your Medicare number, current healthcare coverage, and any other relevant information requested by AARP.

- Choose a Plan: AARP offers different secondary insurance plans, so make sure to review and choose the one that best fits your healthcare needs and budget.

- Complete Application: Fill out the enrollment application accurately and submit it within the specified deadline to ensure coverage starts when needed.

- Wait for Approval: Once you submit your application, AARP will review it and notify you of your enrollment status. If approved, you will receive confirmation details.

Enrollment Deadlines and Periods

It is important to be aware of any specific enrollment periods or deadlines set by AARP for signing up for their secondary insurance. Missing these deadlines could result in delays in coverage.

Tips for a Smooth Enrollment Process

- Start Early: Begin the enrollment process ahead of time to avoid any last-minute rush and ensure seamless coverage transition.

- Understand Your Needs: Take the time to assess your healthcare requirements and choose an AARP secondary insurance plan that aligns with your needs.

- Keep Records: Maintain copies of all communication, forms, and documents exchanged during the enrollment process for reference and verification.

- Seek Assistance: If you have any questions or need help with the enrollment process, don’t hesitate to reach out to AARP customer service for guidance.

Customer Satisfaction and Reviews of AARP Secondary Insurance to Medicare

Feedback and reviews from individuals who have AARP secondary insurance alongside Medicare can provide valuable insights into the overall customer satisfaction levels. Here are some common experiences and satisfaction rates with AARP secondary insurance coverage:

Positive Customer Reviews

- Many customers appreciate the comprehensive coverage provided by AARP secondary insurance, which helps fill the gaps left by Medicare.

- The ease of access to a wide network of healthcare providers is another aspect that customers often praise, allowing them to choose the care they need.

- Customers have reported positive experiences with claim processing and customer service, noting quick response times and helpful representatives.

Standout Features of AARP Secondary Insurance

- One of the standout features of AARP secondary insurance is the flexibility it offers in terms of coverage options, allowing customers to tailor their plans to their specific needs.

- The additional benefits provided, such as vision and dental coverage, are highly appreciated by customers who value the comprehensive nature of the insurance.

- AARP’s reputation for reliability and stability in the insurance market gives customers peace of mind knowing they are covered by a trusted provider.

Last Recap

In conclusion, AARP secondary insurance offers a valuable supplement to Medicare, providing enhanced coverage, unique benefits, and peace of mind for beneficiaries. By exploring the details of eligibility, coverage, costs, and enrollment, individuals can make informed decisions to optimize their healthcare options.

Helpful Answers

Is AARP secondary insurance mandatory for Medicare beneficiaries?

No, AARP secondary insurance is optional and can be chosen to supplement existing Medicare coverage for additional benefits.

What are the main advantages of having AARP secondary insurance alongside Medicare?

AARP secondary insurance offers additional coverage options, cost savings, and personalized benefits that can enhance overall healthcare experiences.

Are there any age restrictions for enrolling in AARP secondary insurance?

While there are no specific age requirements, individuals must be enrolled in Medicare to be eligible for AARP secondary insurance.

How do premiums for AARP secondary insurance compare to Medicare premiums?

Premiums for AARP secondary insurance may vary based on factors such as age, location, and coverage options, but they are generally additional to standard Medicare premiums.