Delving into cheap best auto insurance, this introduction immerses readers in a unique and compelling narrative, providing insights into the importance of auto insurance, factors affecting rates, tips for finding affordable coverage, and different types of insurance available. From understanding the risks of driving without insurance to comparing rates from various companies, this guide aims to help you navigate the world of auto insurance with ease.

Importance of Auto Insurance

Auto insurance is a crucial protection for drivers and their vehicles, providing financial security and peace of mind in case of accidents or unforeseen events on the road.

Legal Compliance

Having auto insurance is mandatory in most states to comply with legal requirements. Driving without insurance can lead to hefty fines, license suspension, or even legal penalties.

Financial Protection

- Auto insurance covers the costs of repairs or replacement of vehicles damaged in accidents, saving drivers from significant financial burden.

- In case of injuries to oneself or others, auto insurance can cover medical expenses, reducing out-of-pocket costs.

- Liability coverage protects drivers from lawsuits in case they are at fault in an accident, covering legal fees and settlement costs.

Unforeseen Circumstances

Auto insurance provides coverage for theft, vandalism, natural disasters, and other unforeseen events that could damage or total a vehicle, ensuring drivers are not left stranded without a means of transportation.

Factors Affecting Auto Insurance Rates

When it comes to determining auto insurance rates, several factors play a crucial role in influencing the premiums that individuals pay. Understanding these factors can help drivers make informed decisions when selecting an auto insurance policy.

Driving Record

A major factor that impacts auto insurance rates is an individual’s driving record. Drivers with a history of accidents, traffic violations, or DUIs are considered high-risk by insurance companies, leading to higher premiums. On the other hand, drivers with a clean record typically qualify for lower insurance rates as they are perceived as safer and less likely to file claims.

Age and Experience, Cheap best auto insurance

Younger and inexperienced drivers often face higher insurance premiums due to their higher likelihood of being involved in accidents. Insurance companies view younger drivers as riskier and therefore charge them more for coverage. As drivers gain more experience and establish a clean driving record, their insurance rates tend to decrease.

Type of Vehicle

The type of vehicle being insured also affects auto insurance rates. High-performance cars, luxury vehicles, and models with high repair costs or susceptibility to theft generally result in higher insurance premiums. On the other hand, older, safer, and more affordable vehicles typically have lower insurance costs.

Location

Where a driver lives can significantly impact auto insurance rates. Urban areas with higher traffic congestion and crime rates tend to have higher premiums compared to rural areas. Additionally, states with no-fault insurance laws or high rates of uninsured drivers may also lead to increased insurance costs.

Credit Score

Insurance companies often consider an individual’s credit score when determining auto insurance rates. A higher credit score is typically associated with lower insurance premiums, as it is viewed as an indicator of financial responsibility. On the other hand, individuals with lower credit scores may face higher insurance costs.

Tips for Finding Cheap Auto Insurance

When looking for affordable auto insurance, there are several strategies you can use to lower your insurance premiums and find the best rates.

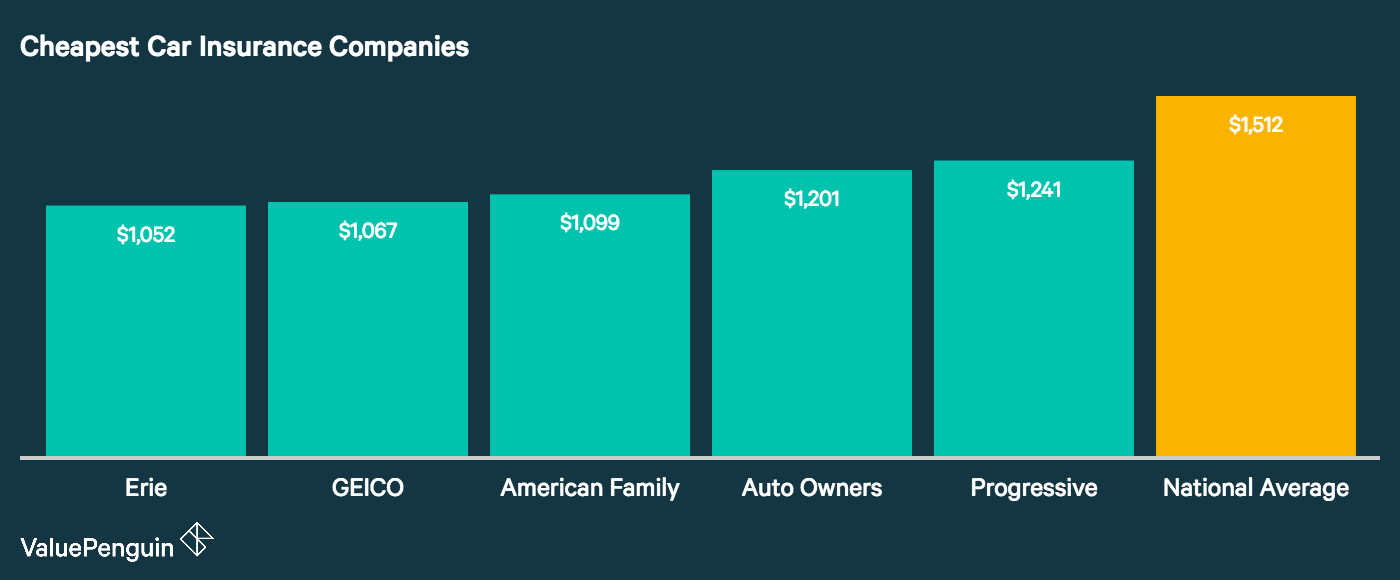

Compare Multiple Insurance Companies

One of the most effective ways to find cheap auto insurance is to compare quotes from multiple insurance companies. Each company has its own pricing structure, so shopping around can help you find the best deal.

- Obtain quotes from at least three different insurance companies.

- Consider both large national insurers and smaller regional companies.

- Look for discounts and special offers that may be available.

Adjust Your Coverage

Another way to lower your auto insurance premiums is to adjust your coverage levels. By carefully choosing the coverage options you need, you can save money on your policy.

- Consider raising your deductibles to reduce your premium costs.

- Determine if you can reduce coverage on older vehicles that may not need comprehensive or collision insurance.

- Review your policy regularly to make sure you are not paying for coverage you no longer need.

Improve Your Driving Record

Your driving record has a significant impact on your auto insurance rates. By maintaining a clean driving record, you can qualify for lower premiums and discounts from insurance companies.

- Avoid traffic violations and accidents to keep your record clean.

- Consider taking a defensive driving course to improve your driving skills and qualify for discounts.

- Ask your insurance company if they offer discounts for safe driving habits or usage-based insurance programs.

Types of Auto Insurance Coverage

Auto insurance coverage comes in various types, each offering different levels of protection for drivers and their vehicles. Understanding the different types of coverage available is crucial in selecting the right policy that suits your needs.

Liability Insurance

Liability insurance covers the costs of damages and injuries to others in an accident where you are at fault. This type of coverage is typically required by law in most states.

- Benefit: Provides financial protection from legal claims and medical expenses of others involved in an accident.

- Example: If you cause an accident that injures another driver or damages their vehicle, liability insurance will cover their medical bills and repair costs.

Collision Insurance

Collision insurance covers the costs of repairing or replacing your vehicle after a collision, regardless of who is at fault.

- Benefit: Protects your vehicle from damages in accidents, regardless of fault.

- Example: If you collide with another vehicle or object, collision insurance will cover the costs of repairing your car.

Comprehensive Insurance

Comprehensive insurance covers damages to your vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters.

- Benefit: Provides coverage for a wide range of non-collision related damages.

- Example: If your car is stolen or damaged in a hailstorm, comprehensive insurance will cover the costs of repair or replacement.

Uninsured/Underinsured Motorist Coverage

This type of coverage protects you in case you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Benefit: Ensures you are financially protected if hit by an uninsured or underinsured driver.

- Example: If you are in an accident with a driver who does not have insurance, uninsured/underinsured motorist coverage will cover your medical expenses and damages.

End of Discussion: Cheap Best Auto Insurance

In conclusion, finding the best auto insurance doesn’t have to break the bank. By considering the factors influencing rates, utilizing tips for savings, and understanding the types of coverage available, you can secure a policy that suits your needs and budget. Stay informed, stay protected, and drive with confidence knowing you have the cheap best auto insurance on your side.

User Queries

What are the risks of driving without auto insurance?

Driving without auto insurance can lead to hefty fines, legal penalties, license suspension, and financial vulnerability in case of an accident.

How can I lower my insurance premiums?

You can lower your insurance premiums by maintaining a good driving record, opting for a higher deductible, bundling policies, and comparing quotes from different insurers.

What types of auto insurance coverage are available?

Common types of auto insurance coverage include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection.