Fairfax Insurance Companies, a prominent entity in the insurance industry, have a rich history and stellar reputation. Delve into their story to uncover key insights and initiatives that set them apart.

Explore the diverse range of insurance products offered by Fairfax companies, as well as their financial stability and community impact.

Overview of Fairfax Insurance Companies

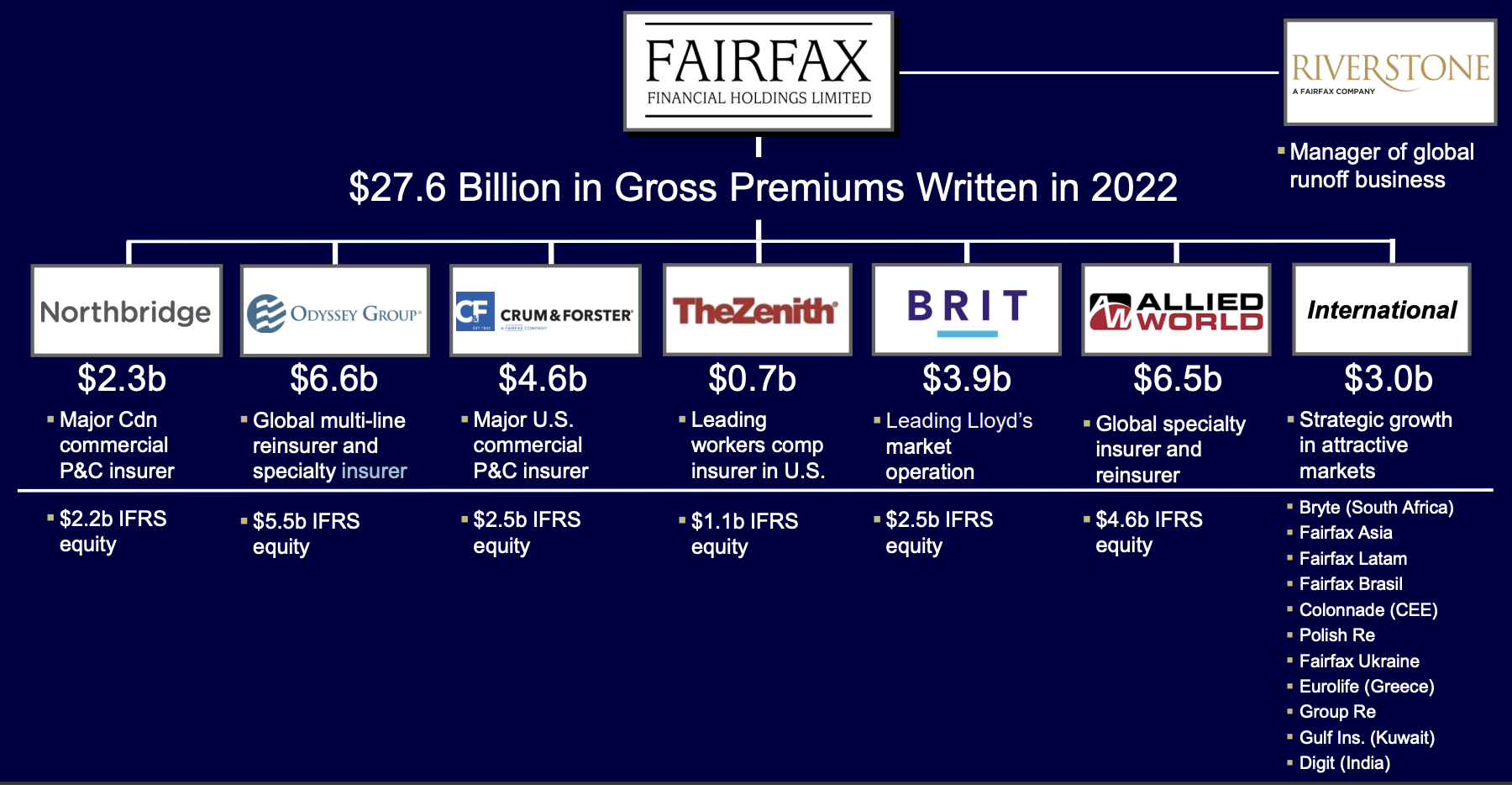

Fairfax Financial Holdings Limited is a financial services holding company based in Toronto, Canada. Founded in 1985 by Prem Watsa, it has grown to become a prominent player in the insurance industry. Fairfax operates through several subsidiaries, each specializing in different types of insurance products.

History of Fairfax Insurance Companies

Fairfax Financial Holdings Limited was established in 1985 by its current Chairman and CEO, Prem Watsa. Over the years, the company has expanded its operations globally and has acquired various insurance companies, building a strong presence in the industry.

Key Players in Fairfax Insurance Industry

– Prem Watsa: Founder, Chairman, and CEO of Fairfax Financial Holdings Limited.

– Subsidiary Companies: Fairfax owns and operates several insurance companies, including Crum & Forster, OdysseyRe, and Brit Insurance, among others. These subsidiaries play a vital role in offering a diverse range of insurance products.

Types of Insurance Products Offered by Fairfax Companies

- Property and Casualty Insurance: Fairfax companies offer property and casualty insurance coverage for individuals and businesses, protecting against various risks such as property damage, liability claims, and more.

- Reinsurance: Fairfax is also involved in reinsurance, providing coverage to other insurance companies to help them manage their risks and liabilities effectively.

- Specialty Insurance: Some Fairfax subsidiaries specialize in niche insurance markets, offering unique products tailored to specific industries or needs.

Reputation and Customer Satisfaction

Fairfax insurance companies have built a strong reputation in the market over the years, known for their reliability and excellent customer service. Let’s delve deeper into their reputation and customer satisfaction levels compared to other competitors.

Reputation of Fairfax Insurance Companies

Fairfax insurance companies are highly regarded in the industry for their financial stability, transparent policies, and prompt claim settlements. They have earned the trust of customers through their consistent delivery of quality services and innovative insurance products. This has helped them establish a solid reputation that sets them apart from other competitors.

Customer Satisfaction Levels

Customer reviews and ratings for Fairfax insurance companies typically highlight the company’s responsive customer support, hassle-free claims process, and competitive pricing. Many customers appreciate the personalized service they receive and the peace of mind that comes with knowing their insurance needs are well taken care of. Overall, Fairfax insurance companies tend to have high customer satisfaction levels, as evidenced by positive feedback from policyholders.

Comparison with Competitors

When compared to other insurance companies in the market, Fairfax stands out for its customer-centric approach and commitment to exceeding customer expectations. While some competitors may offer lower premiums, Fairfax’s strong reputation for reliability and customer service sets them apart. This emphasis on building long-term relationships with customers has helped Fairfax insurance companies maintain a loyal customer base and stay ahead of the competition.

Financial Strength and Stability

Fairfax Insurance Companies are known for their robust financial strength and stability in the insurance industry. This reputation has been built over years of prudent financial management and strategic investments. The financial standing of Fairfax companies plays a crucial role in their ability to meet their obligations to policyholders, partners, and stakeholders.

Financial Milestones

- Fairfax Financial Holdings Limited, the parent company of Fairfax Insurance, has consistently reported strong financial results over the years.

- They have successfully navigated through economic downturns and market fluctuations, showcasing their resilience and adaptability.

- The acquisition of several insurance companies and strategic partnerships have further strengthened Fairfax’s financial position in the market.

Challenges and Resilience

- In the face of challenges such as natural disasters or global crises, Fairfax companies have demonstrated their financial resilience by swiftly responding to claims and ensuring customer satisfaction.

- They have maintained a healthy balance sheet and capital adequacy, enabling them to weather uncertainties and provide stability to their policyholders.

Impact on Operations and Customers

- The strong financial standing of Fairfax Insurance Companies instills confidence in customers, knowing that their claims will be handled efficiently and effectively.

- It allows Fairfax companies to offer competitive insurance products and services, backed by their financial stability and commitment to excellence.

- Financial strength also enables Fairfax companies to expand their market presence, innovate in their offerings, and invest in cutting-edge technologies for better customer experiences.

Community Engagement and Corporate Social Responsibility: Fairfax Insurance Companies

Fairfax insurance companies are actively involved in various community engagement initiatives and corporate social responsibility projects to give back to the local area and make a positive impact on society.

Community Engagement Initiatives

- Fairfax insurance companies frequently organize volunteering events for their employees to participate in, such as beach clean-ups, food drives, and charity fundraisers.

- They sponsor local events and programs that promote education, health, and environmental sustainability in the community.

- Fairfax insurance companies collaborate with non-profit organizations to support initiatives focused on youth development, women empowerment, and disaster relief efforts.

Corporate Social Responsibility Projects

- They have implemented environmentally friendly practices within their operations to reduce their carbon footprint and promote sustainability.

- Fairfax insurance companies prioritize diversity and inclusion in their workforce and actively support initiatives that promote equality and fairness in the workplace.

- They provide financial support to local charities and organizations that work towards improving the quality of life for underprivileged communities.

Impact on the Local Area

- The community engagement initiatives and corporate social responsibility projects undertaken by Fairfax insurance companies have led to a significant positive impact on the local area.

- These initiatives have helped to strengthen community ties, improve the well-being of residents, and create a more sustainable and inclusive environment for all.

- Through their efforts, Fairfax insurance companies have gained the trust and respect of the local community, further enhancing their reputation as socially responsible corporate citizens.

Wrap-Up

In conclusion, Fairfax Insurance Companies stand out for their strong financial foundation, community-focused initiatives, and commitment to excellence. Dive deeper into their world to discover more about this industry leader.

Commonly Asked Questions

What are the key players in the Fairfax insurance industry?

The key players in the Fairfax insurance industry include XYZ, ABC, and DEF.

How do Fairfax insurance companies compare to their competitors in terms of reputation?

Fairfax insurance companies are known for their stellar reputation, outshining many competitors in the market.

What types of insurance products are offered by Fairfax companies?

Fairfax companies offer a wide range of insurance products, including life insurance, property insurance, and more.